Minimum wage calculator after tax

National Minimum Wage and Living Wage calculator for workers. Minimum Wage Salary After Tax.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Apr 07 2022 The formula for after-tax income is quite simple as given below.

. The money you take home after all taxes and contributions have been deductedThe average monthly net. To calculate the after-tax income simply subtract total taxes from the gross income. United States US Salary After Tax Calculator.

The money you take home after all taxes and contributions have been deductedAlso known as Net Income. The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. This places US on the 4th place out of 72 countries in the.

United States US Salary After Tax Calculator. This is equivalent to 289348 per month or 66773 per week. Our 2022 GS Pay Calculator allows you to calculate the exact salary of.

See where that hard-earned money goes - with UK income tax National. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Living Wage Calculation for Fairfax County Virginia.

Your average tax rate is. But calculating your weekly take-home. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. How Your Paycheck Works. You can use our Irish tax calculator to estimate your take-home salary after taxes.

Your average tax rate is. Your employer owes you past payments from the previous year because of underpayment. Earning The Adult Minimum Wage per year before tax in New Zealand your net take home pay will be 3472176 per year.

That means that your net pay will be 43041 per year or 3587 per month. For example lets assume. The new version no longer lets you claim allowances as it instead features a five-step process that asks you to enter annual dollar.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. That means that your net pay will be 37957 per year or 3163 per month. Just type in your gross salary select how frequently youre paid and then press Calculate.

You must be at least 23 years old. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. The IRS has recently made revisions to the Form W-4. Minimum Wage Salary After Tax.

See where that hard-earned money goes - Federal Income Tax Social Security and.

How To Calculate Net Pay Step By Step Example

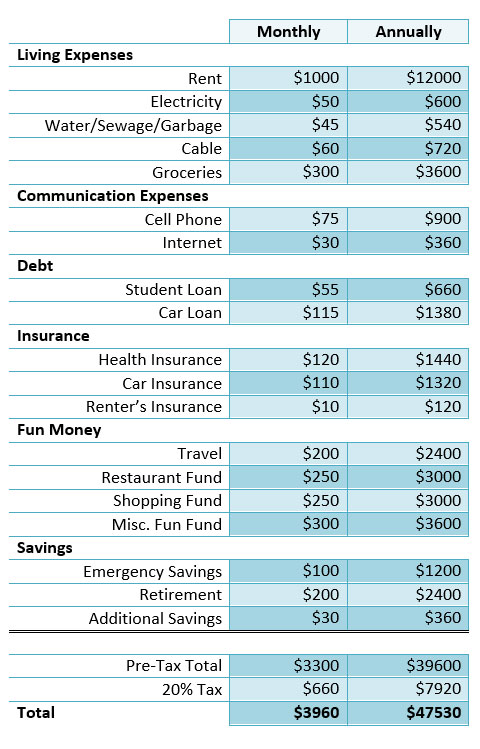

How To Calculate How Much You Need To Earn

Annual Income Calculator Clearance 60 Off Www Ingeniovirtual Com

Pay Raise Calculator

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

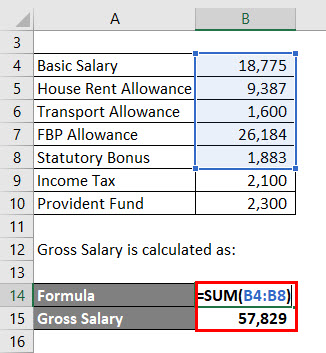

Salary Formula Calculate Salary Calculator Excel Template

Hourly To Salary What Is My Annual Income

Annual Income Calculator Clearance 60 Off Www Ingeniovirtual Com

How To Calculate Wages 14 Steps With Pictures Wikihow

California Paycheck Calculator Smartasset

Salary Formula Calculate Salary Calculator Excel Template

Pay Raise Calculator

Us Hourly Wage Tax Calculator 2022 The Tax Calculator

New York Hourly Paycheck Calculator Gusto

Hourly Wage To Biweekly Paycheck Converter Hourly Salary Conversion Calculator

How To Calculate Wages 14 Steps With Pictures Wikihow

Payroll Tax Calculator For Employers Gusto